Andreas Forssell: ”Forest commodities stand strong in a stormy world”

First of all I want to say that my thoughts are with the sufferings of the people of Ukraine and that all we do in our day-today operations should be seen in the light of their struggle for survival. I feel it´s important to state this because for us as a business things are looking brighter rather than darker.

What exactly is brighter for Eternali as a business?

Our business is to source and deliver forest commodities; primarily eucalyptus logs, so allow me to develop how we see the current market outlook. Let´s start with inflation, where the normal development is that commodity companies, that undoubtedly are first in the value chain, usually can compensate fully for inflationary costs and wages. Simply because they are first. Next stop are industries and they can almost reach full compensation (from higher commodity prices), then you have the importers followed by distributors and for each step in the value chain the possible compensation is smaller. All in all: in an inflationary world it´s good to be at the starting end of the value chain.

And how is the market for forest commodities effected by the war?

As for the wood market repercussions we can already see that the supply from Russia and Belarus will be cut off and of course subdued from Ukraine. All together Russia, Belarus and Ukraine represent 8% of the total European wood consumption, primarily in the segment of pulp wood and wood chips. This adds even further to the gap between supply and demand in Europe, which will push prices upwards.

What about the fossil energy crisis, what´s your take?

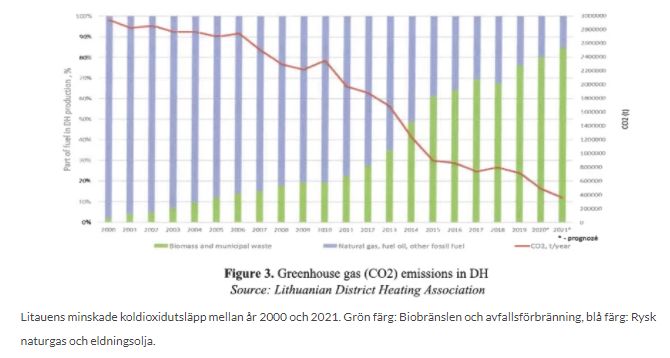

When it comes to the energy transition from fossil to sustainable energy it is clear that the EU is finally waking up from the deceptive dream of cheap and endless Russian fossil fuel. This means that a speedier transition has become a target. Driven not only by climate concerns but pure security concerns. However, building wind mills, solar power plants or nuclear plants takes time. We therefore believe eucalyptus is a key part of the sustainable energy puzzle, as it grows fast and can supply bio-energy plants with much-needed raw material. An inspiration in this context comes from Lithuania, which during the last ten years has switched the country´s district heating plants from being fueled by imported Russian natural gas to domestically produced bio-energy from wood and waste.

Eternali´s plan for a listing this fall still holds?

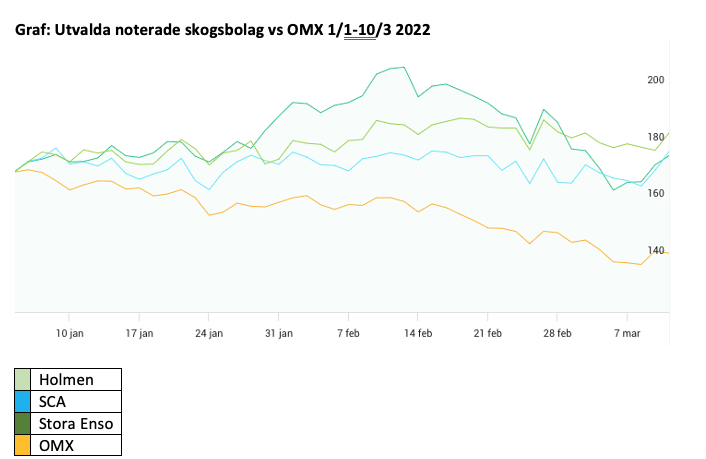

As I see it today, yes, definitely. Across the world stock indices are down, but the trend was down already before the war started. As of today, 10 March, the OMXS30 is down 16% since 1 Jan. The interesting thing to notice is that the market seems to share our own outlook when it comes to inflation, the war and future energy sources. Consequently, most of the listed forest companies have performed well. Since 1 Jan Holmen, Stora Enso and SCA are all up +2% to +6%.

I would even push the envelope and claim that a pure-play forest company – without an industry arm – has an even brighter future. As Danske Bank states in their March report on forestry (Swedish only): ”Sharply increased demand for wood. But where to find it?”. A lot of things will surely happen along the way but the underlying trends we lean on are both strong and long term.